Imagine standing on the horizon of a revolutionary reform that could alter the system of healthcare financing forever. Every decision would be sharper, and every strategy more effective. This is not a distant dream, but a tangible reality within reach through a profound evolution in healthcare cash posting. This is a move that would benefit us for ages to come, an action that could redefine decision-making in the market of healthcare finance. Unparalleled visibility would be implemented into financial operations, and healthcare support would revise a long-carried struggle.

Unlocking the power of clarity within healthcare financing, among the intricate dance of healthcare financial management, cash posting plays a lead role. It’s the meticulous process of recording and reconciling patient payments and insurance reimbursements, a task that forms the backbone of a healthcare provider’s financial health. Originally viewed as a routine clerical task, cash posting, upon fulfilling the target of enhanced visibility and strategic insight, becomes a game-changer.

Operational Impediments:

Manual Processing The Error-Prone Trail:

Picture the all-too-familiar scene of manual data entry, a path ripe with human error and delay. These errors are not just speed bumps; they are roadblocks that slow down the entire process, escalating the risk of inaccuracies.

The Reconciliation Quagmire:

Shifting through a mountain of transactions, trying to match each payment with its invoice. This can quickly turn into a Herculean task, leading to a backlog of unapplied cash, which in turn can throttle cash flow and skew financial reporting.

The Puzzle of Diverse Payment Methods:

In an era where payment options have skyrocketed in availability, cash posting has become a more intricate puzzle. Navigating the nuances of each payment type can make the process not just complex but also error prone.

Fragmented Financial Systems – A Jigsaw Puzzle:

When billing, accounting, and customer management systems operate in silos, the result is a fragmented financial jigsaw. The extra effort to piece together information across these platforms can be both time-consuming and fraught with errors.

The Tightrope Walk of Compliance and Security:

Balancing the act of regulatory compliance and securing payment information is no less than walking a tightrope. A misstep here can have serious legal and reputational consequences.

Payment Posting

A critical component of a successful Healthcare Revenue System

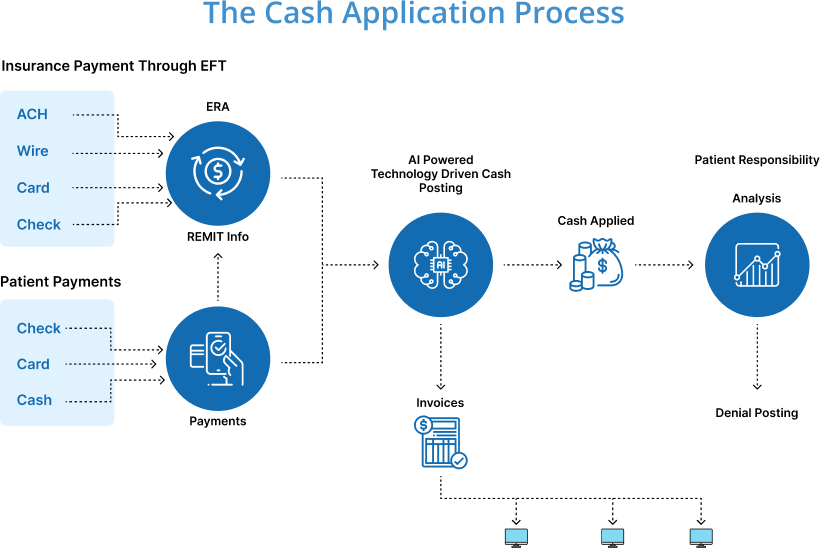

The payment posting process records payments from patients and insurance companies into patient accounts – is pivotal. This intricate procedure encompasses several critical steps, each with unique challenges, that collectively ensure financial accuracy and compliance.

Mastering the Art of Precision in Payment RecordingAt the forefront of this adventure is the exacting task of recording payments with unerring precision.

Grand Balancing Act with Deposit SlipsPayment posting requires a skillful balance, ensuring that recorded payments precisely match the deposit slips to prevent financial mismatches and maintain flawless financial accuracy.

Underpayment Detective WorkBy implementing advanced visibility systems in their financial operations, healthcare providers gain immediate insights into cash flow and transaction status, revolutionizing their financial management.

Digital Leap in Payment PostingShifting to electronic payment posting ushers in an era of increased efficiency and minimized errors, necessitating a strong technological infrastructure for a smooth and seamless digital handling of payment data.

Strategic Management of EOB FilesManaging Explanation of Benefits (EOB) files is like orchestrating a grand library – systematic, accessible, and essential for future reference and compliance audits.

Why Does Visibility in Cash Postings Matter?

According to Katie Nunn, MBA, CMPE, a practice management consultant in Richmond, Virginia, “Most payers are banking on you not doing this,” she says. “Payers are smart enough to know whether you’re going to work your A/R (accounts receivable) or not. You could be taken advantage of.”

Why Every Minute Matters?

In RCM, time efficiency is synonymous with financial efficiency. The extra minutes spent on manual transaction processing accumulate over time, leading to increased labor costs and potential delays in payment postings. This can have a ripple effect on the entire revenue cycle, affecting cash flow and operational efficiency.

The Path to Revolutionizing Cash Posting

Embracing Technology : The adoption of advanced software and analytics tools can provide real-time data and insights, turning raw numbers into actionable intelligence.

Process Optimization : Re-evaluating and refining cash posting processes to eliminate inefficiencies and embrace best practices ensures a smoother financial operation.

Continuous Training and Education : Keeping staff updated with the latest trends and technologies in financial management is key to maintaining a high level of competency and insight.

The Impact of a Revolutionized Approach

When healthcare providers embrace this new approach to cash posting, the benefits are manifold. They gain a stronger command over their financial operations, leading to improved cash flow management and reduced revenue leakages. This enhanced financial visibility not only aids in strategic decision-making but also elevates the overall quality of healthcare delivery by allowing providers to focus more on patient care and less on financial ambiguities.

Advocacy for Robust Visibility Mechanisms:

Upon advocating for and implementing robust visibility systems in their financial operations, healthcare providers would be adopting cutting-edge solutions that provide on-the-spot insights into cash flow and transaction status.

Regulatory Adherence:

Ensuring strict adherence to regulatory requirements is essential. Implementing systems that automatically flag potential compliance issues can help prevent costly penalties and legal challenges.

Sustainable Partnerships:

Building and maintaining sustainable partnerships with all stakeholders, including patients, payers, and vendors, is vital. Transparent and efficient financial processes foster trust and reliability in these relationships.

We envision a future where clarity reigns supreme in the financial stratosphere. Our mission is to break the chains of obfuscation and illuminate the corridors of cash posting. This is our declaration of financial liberation!

Connect with our team today for a deeper understanding or any questions you may have. We’re here to help!