In the intricate world of healthcare, efficient patient care and financial management hinge on the often-overlooked step of benefits verification. Neglecting this process can unravel the healthcare system’s efficiency, much like pulling a thread from a tapestry. This negligence is evident in the rise of medical claims denials, which jumped from 1.5% to 2.5% of gross revenue between January 2021 and August 2022. Studies show that these denials often stem from small gaps in patient information, disrupting the entire healthcare framework.

Early-Stage Revenue Cycle Errors: The Root of Revenue Leakage

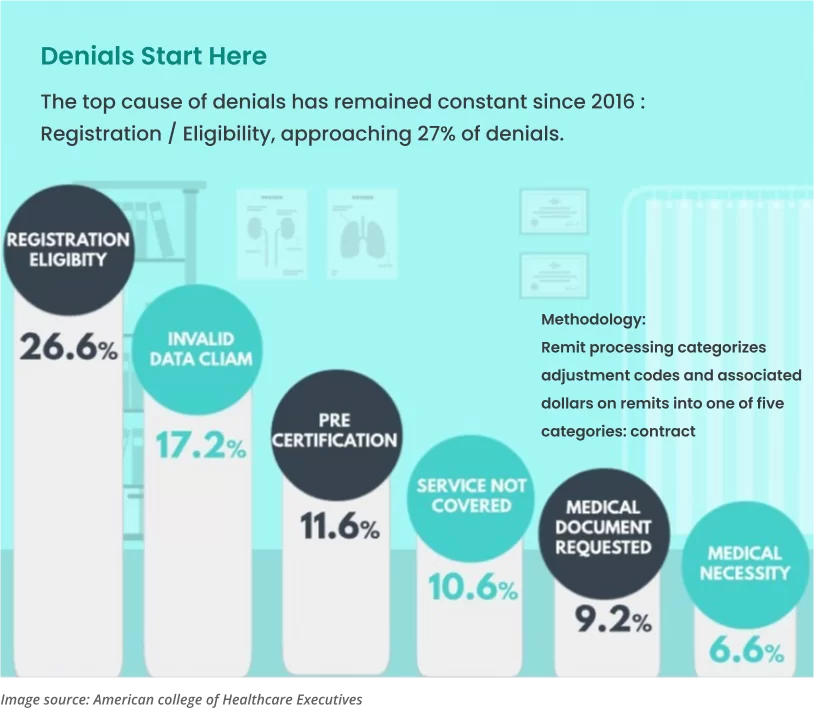

Up to 50% of all denials originate from initial revenue cycle issues, including registration errors and outdated patient information. Simple mistakes in these early stages act as cracks in the revenue flow, with expired insurance policies often blocking reimbursements.

Prior Authorizations: Balancing Cost, Necessity, and Safety

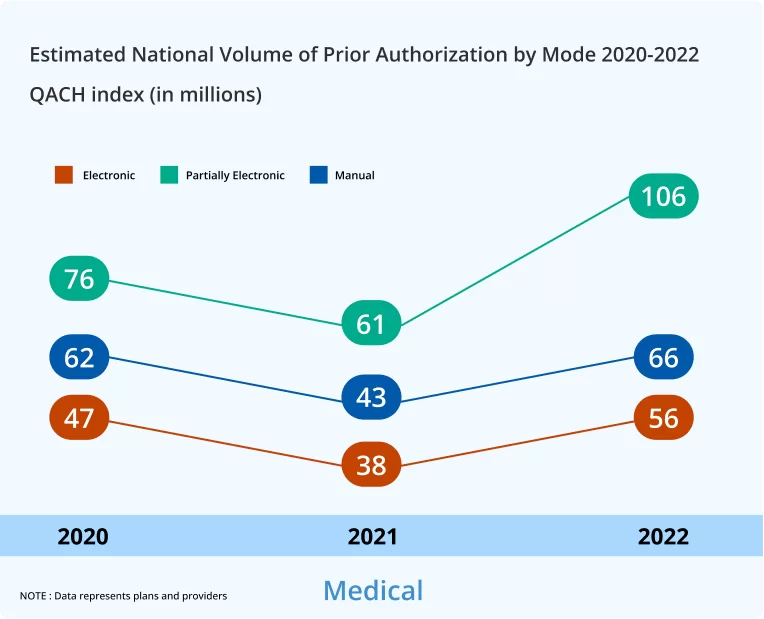

Despite causing delays and administrative burdens, prior authorization is vital for confirming treatment appropriateness, controlling healthcare costs, preventing unnecessary procedures, and protecting patients from potentially harmful or unnecessary medical interventions. Prior authorizations play a multifaceted role in healthcare:

Challenges in Authorization Codes (CO 15):

Incorrect or missing authorization codes often lead to claim rejections, causing financial and administrative strain. The complexity of insurance policies, frequently subject to changes, exacerbates this challenge. Automated systems can expedite and improve the accuracy of this process, reducing human error and keeping pace with policy updates.

According to a Kaiser Health Tracker survey, health costs incurred by families with insurance coverage from large employers — including premium contributions and out-of-pocket spending on health services — increased by 67% from 2008 to 2018.

At the same time, payers have been requiring more and more time-consuming prior authorizations before they will pay for a service, procedure, or prescription medication. This is evidenced by a 2019 American Medical Association survey in which 86% of responding doctors said their prior authorization burden had increased over the past five years.

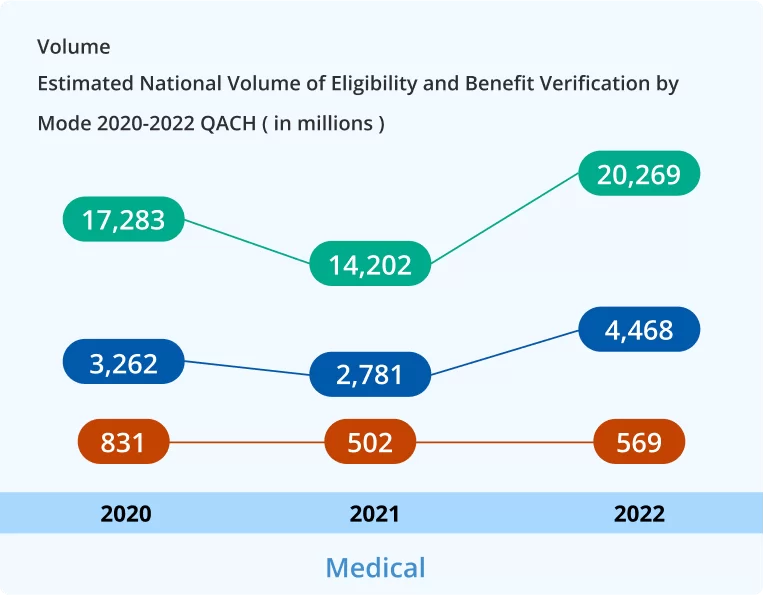

Eligibility Verification: Ensuring Smooth Claim Processing

Eligibility verification is a cornerstone in the healthcare industry, playing a pivotal role in ensuring efficient claim processing and overall system effectiveness. Here’s a closer look at its multifaceted benefits:

Preventing Claim Rejections and Delays

By confirming service eligibility beforehand, healthcare providers can avoid the disruptions of payment delays and claim rejections. This process safeguards a stable cash flow, crucial for operational continuity.

Enhancing Revenue Cycle Management

Accurate eligibility checks are integral to minimizing billing errors and the costs linked to claim denials. This efficiency is vital for robust revenue cycle management and maintaining the financial health of healthcare services.

Improving Patient Satisfaction

Early verification of coverage helps patients understand their financial responsibilities upfront. This transparency reduces the likelihood of unexpected bills, thereby enhancing patient satisfaction and trust in the healthcare system.

Reducing Administrative Burdens

Streamlined verification processes alleviate the administrative load on healthcare staff. This efficiency allows them to devote more time and resources to patient care, improving service quality and patient outcomes.

Compliance with Regulations

Eligibility verification ensures that healthcare claims align with payer rules and regulations. This compliance is key to avoiding legal issues and financial penalties, safeguarding both the provider and the patient.

Mitigating Financial Risks

By verifying coverage, healthcare providers can protect themselves and their patients from the financial risks associated with services not covered by insurance. This step is crucial to avoiding unexpected expenses and financial disputes.

Facilitating Coordinated Care:

In cases involving multiple healthcare providers, eligibility verification clarifies insurance coverage details. This clarity is essential for seamless coordination of care, ensuring that all involved parties are aware of the coverage scope and limitations.

The U.S. Bureau of Labor Statistics classifies medical plans into six types, each with unique healthcare coverage, provider options, and patient costs:

Fee-for-Service Plan:

Traditional insurance with reimbursement for covered services, allowing any provider choice.

Preferred Provider Organization (PPO):

Offers services at reduced rates within a network; higher costs for out-of-network providers.

Exclusive Provider Organization (EPO):

Covers only in-network doctors and hospitals, except emergencies.

Point-of-Service (POS) Plan:

Combines HMO and PPO features with varying coverage levels based on network usage.

Health Maintenance Organization (HMO):

Limits coverage to in-network care, except for emergencies.

Open-Access HMO:

Allows out-of-network care at higher costs, offering more provider flexibility.

Understanding these helps in making informed health insurance choices.

Tackling Information Deficiency (CO-16) and Coordination of Benefits (CO-22)

Addressing the complexity of insufficient data (CO-16) and coordinating benefits among multiple insurers (CO-22) is crucial. These steps accelerate processing, reduce human error, and ensure compliance with policy changes.

Challenges of Expired Insurance (CO-27) and Exceeding Fee Schedules (CO-45)

Managing expired insurance (CO-27) and charges that exceed fee schedules (CO-45) involves navigating complex situations and aligning with updated policies. These efforts streamline the verification process and reduce the margin of error.

Addressing Non-Covered Diagnoses (CO-167)

Handling diagnoses not covered by payers (CO-167) requires a thorough understanding of coverage limitations and precise verification systems to avoid delays and errors in coverage determination.

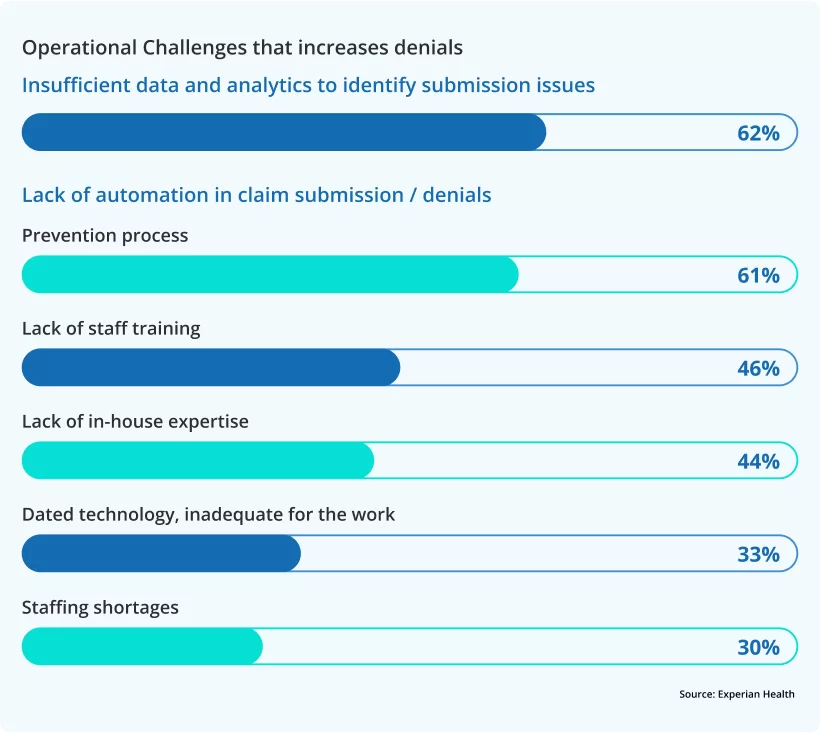

Concluding Thoughts: A Roadmap to Revenue Recovery

Imagine your organization as a ship navigating through the stormy seas of business challenges. To prevent the leak that threatens your voyage – revenue leakage – a holistic and robust strategy is your essential toolkit. Picture automation as your skilled crew, streamlining tasks with precision, while data and analytics serve as your navigational charts, guiding decisions with clarity. Upskilling your staff is like equipping your sailors with better tools, ensuring they’re ready for any challenge. Recruiting expert talent is akin to bringing experienced navigators on board, enhancing your journey’s success.

Addressing operational challenges and modernizing technology are like repairing and upgrading your ship, making it stronger and more efficient. Finally, fostering collaboration and continuous monitoring ensures all hands are on deck, working in unison towards a common goal.

By embracing this comprehensive strategy, your organization can not only plug the leaks but also sail towards a horizon of financial health and competitive edge. This journey requires commitment and action – start today and steer your ship to calmer, more prosperous waters.