Imagine a space saving virtual workplace filled with thousands of virtual robots that have learned and are mimicking human actions for repetitive tasks – working 24 x 7 and with 100% accuracy – that in a nutshell is Robotic Process Automation (RPA).

Businesses today are looking to reap the rewards of intelligent automation technology in business process automation. RPA fits the bill perfectly and why it outperforms traditional automation. RPA software robots never sleep and perform time consuming and repetitive tasks using Artificial Intelligence (AI) and Machine Learning (ML) capabilities.

The result is a robotic digital workplace which uses bots as its workforce working alongside and in synergy with your human workforce, each doing what they are best suited to.

What is Traditional Automation

Traditional automation is a decades old technology and is based on APIs and programming that integrates with different systems. In this form of automation, the developer needs to understand the target system. This is the primary difference when compared to Robotic Process Automation. Since RPA mimics user actions, it works at the level of the user interface and does not have to worry about the complexity of the underlying applications.

We will take a closer look later in this article about the advantages of robotic process automation vs traditional automation but first here are the processes that would benefit from RPA.

Also Read: 7 Benefits of Automating Inventory and Asset Management

Which processes can be automated through RPA?

Processes that have a traceable pattern and can be taught through a series of instructions to a machine are the typical processes to automate through RPA. Such processes occur right across different industries.

- Insurance: RPA Bots can improve costs as well as customer experience through every step of the customer journey. It finds wide application in the adjudication process, claims management, customer on-boarding, as well as report automation

- Financial services: Automating customer on-boarding, customer service, new application processing, data migration, as well as in credit and loans decisioning.

- Healthcare: Improves patient experience by automating patient preauthorization, claims processing, medical record and data management, as well as operational analytics.

- Manufacturing: automating the toughest processes such as freight costing, invoice verification and auditing, purchase order, processing, inventory management and transport management.

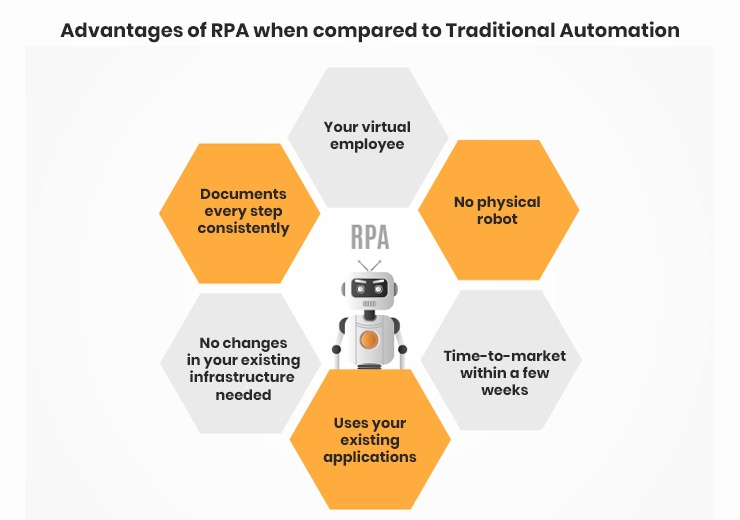

Advantages of RPA when compared to Traditional Automation

1. Technology and ease of integration

RPA does not modify your organization’s IT infrastructure. Instead it sits on top of it. So, you can implement RPA quickly and efficiently without any need to change your existing infrastructure and systems. If you are looking for updating databases and other processes in different IT environments, RPA is your robot of choice. It can even work with no-API and legacy systems. This puts it ahead of traditional automation which requires certain customizations in your existing IT infrastructure.

2. Implementation time

RPA implementation in your business can be completed in weeks because of its use of graphical user interfaces and hence it does not need to be integrated with applications. For instance, RPA can provide payroll data by extracting data from word documents without requiring integration. Traditional Automation however can take several months for implementation. Speed to market is one of the biggest benefits of RPA technology.

3. Degree of scalability

Traditional automation would require significant time and effort to scale its implementation in your business. RPA on the other hand is highly scalable – the number of virtual employees manning your digital workplace can be increased/decreased purely based on need.

4. Level of customization

RPA offers a high level of customization for your business processes. It enables users in your organization to create bots that can meet your particular needs. It can be combined with applications like calendar, e-mail, ERP and CRM to synchronize information and create automated responses. However, the integration of different systems with Traditional Automation is a challenge due to the limitations of APIs.

5. Imitating human actions

This is one of the benefits of RPA compared to traditional automation. RPA works by imitating human actions to complete the tasks. Traditional automation does not imitate human actions but rather executes pre-defined programmed instructions.

6. Virtual vs physical machines

RPA technology facilitates your business to assign tasks to thousands of virtual machines without physical machines being required. On the other hand, traditional automation would require your business to provide physical machines to perform tasks.

Also read: How businesses use ML to improve processes

7. Cost efficiency

Save your employees from the drudgery of repetitive tasks. Since RPA handles the voluminous repetitive tasks of your business efficiently, you free your employees to focus on other tasks that would require human inputs such as judgement, creativity or interpersonal skills. It is estimated that RPA systems can yield an ROI ranging from 30 – 200% in the first 12 months after implementation. In the long run, traditional automation is more costly.

8. Accuracy

RPA streamlines processes and improves the quality of output, thereby increasing accuracy. Robots follow rules consistently therefore the results bear the stamp of accuracy without the concern of human error which dogs traditional automation.

9. Consistency in output

If you were to have the same task performed by humans and bots, you could compare the output to test its consistency efficiently. Consistency is the hallmark of RPA. This sets RPA apart especially when traditional automation projects carry the risk of a significant failure rate.

Can RPA replace traditional automation?

Can an excavator replace a shovel? Obviously not.

Traditional automation still has its niche uses. For instance, when you need to move voluminous data between systems, traditional automation would deliver expeditiously and would therefore be more suitable.

The world appears to be on track to fulfill Gartner’s prediction that 90% of large organizations globally will have adopted RPA in some form by 2022. The Deloitte Global RPA survey reported significantly encouraging results – implementing RPA resulted in 92% improved compliance, 90% improved accuracy and 86% improved productivity.

Our RPA experts are on standby to answer any questions you might have on integrating RPA software into your business processes. Contact us to know more.