The main causes behind medical billing errors

Medical billing is a complex process that starts with benefits verification and goes through claim submission, claims adjudication, and finally patient statement preparation – if all goes according to expected outcomes. However, if a claim is denied there are usually common reasons responsible for it:

Duplicate claims: Healthcare dollars get wasted on filing two claims on the basis of the same encounter. Duplicate claims contribute between 20% -30% of claim denials across the industry.

Filing outside the time frame:Each payer has its own time frame for filing a claim. This can be as short as 15 days but is usually about 90 days to 1 year from the date of service.

Incomplete provider credentials: Surprisingly, there often are errors in the insurance ID number on a claim . This is because of inaccurate data collection or entry. At times ID numbers from old insurance cards that are no longer recognized might be provided.

Noncovered services: A service might be deemed as not medically necessary according to the payers policy because of the diagnosis on the claims form.

Bundled services: Sometimes a service might have already been captured as part of another billed service.

Ultimately, for every 15 denials that are prevented each month, a medical practice can save up to $4,500 per year on costs of correcting and resubmitting claims. To prevent denials in medical billing process requires experienced staff, this is why many medical practices have outsourced their process to proven companies like iTech’s benefit verification services that has developed proprietary automation in healthcare software for its team.

Medical claims denial and appeals statistics

The US Department of Labor has estimated that approximately about 14% of submitted medical claims can be rejected. That works out to about one in seven claims getting denied and that is too high a number. Here are more statistics that you should know about.

$262 billion in medical claims of $3 trillion is denied

This 2017 report from Change Healthcare put the spotlight on the impact of claims denial on medical practices in the United States. It is true that 63% of these denied claims will be recovered in the second or even third submission but it will cost $118 more in appeals related administrative costs. Adding to this twoe is hat everytime a claim is denied the chances of getting full payment is cut.

65% of denied claims are never reworked

This statistic is again from Change Healthcare. If 65% of denied claims are not corrected and resubmitted then practices are losing money. While it is easy enough to say that it can be prevented by making sure correct information is filled on a form, the practical reality is different. While this statistic is alarming, it is essential that all these checkboxes are ticked off:

- Ensure coding rule changes are updated

- Verify insurance benefits

- Have an outsourced team of experts if required

- Use EHR and advanced medical billing software including automation

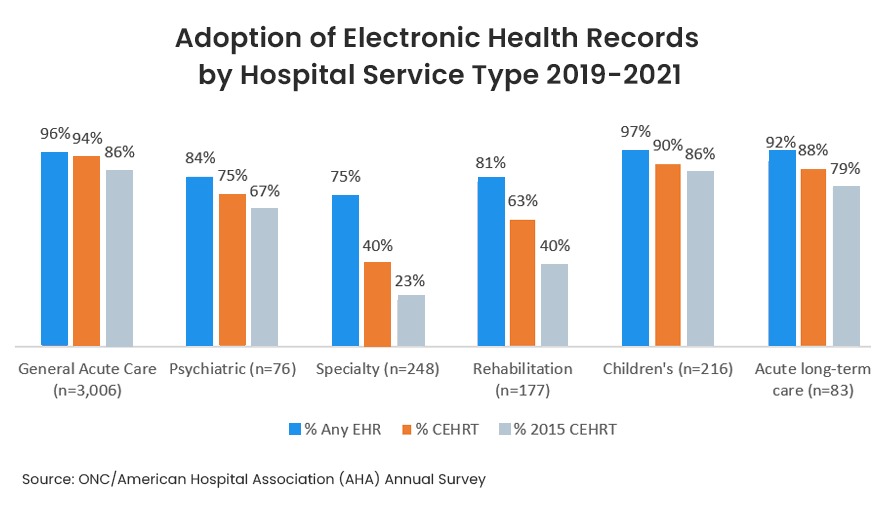

67% of healthcare providers are using EHR (source IQVIA)

Electronic health records software has been proven to reduce errors. It stores all relevant data right from family history, medications taken, treatment provided and also insurance payer information. Since this data is portable across the healthcare network it ensures that access to existing data is always accurate.

Healthcare providers can fill on an average of 20,000 forms a year, depending on their size. This is one of the reasons why many have moved to an EHR system as it is a tedious task. However, data from 2019 to 2021shows that 86% pf non-Federal acute care hospitals have adopted a 2015 edition certified EHR. Yet only 40% of rehabilitation hospitals and 23% of speciality hospitals have adopted a 2015 Edition EHR. The gulf is wide and more providers need to evaluate and migrate to an between different organizations.

EHR helps to reduce time by 1 minute for each claim filing

According to a 2018 Council for Affordable Quality Healthcare Index Report. This might seem insubstantial as a benefit but let us look at it this way – It takes anywhere around 4 Minutes to submit a claim manually. An EHR claim takes only 3 minutes. If your medical practice is submitting 60 claims a day, this would mean a saving of 1 hour every day that could be spent on something else. This is apart from another big benefit and that is the improvement of claims accuracy.

$177 million is the potential annual savings for healthcare providers by using EHR

(2018 Council for Affordable Quality Healthcare Index Report)

While this data may be about 4 years back, the potential for savings is probably more as claims submissions have also shown a 16% increase in 2021. Claims submission is still the medical billing process that has the widest adoption when it comes to electronic transactions. Further, looking into the data, it is found that dental providers have a $80 million annual saving while other medical providers have a potential saving of $124 million. In fact, iTech has seen a greater interest from dental providers in the last one year for either upgrading or implementing new systems for EHR interoperability.

90% of denied claims are preventable. Medical billing, particularly benefits verification can be time-consuming and prone to errors. iTech’s benefit verification team works with medical and dental practices in the USA in two ways. The first, our software teams have implemented EHR interoperable solutions with a special focus on private medical practice special requirements. The second way is through our benefits verification back office team that are equipped with AI solutions for increased accuracy. Contact us to get a demo on EHR software or benefits verification outsourcing.